In retirement when it comes to income there is Social Security and for many retirees the key question this year like every year before it is “will there be a Social Security raise?”

Thankfully the answer to this question of there being a Social Security raise is yes, but unfortunately the answer is not going to be as much as retirees are hoping or need it to be.

What is a Social Security’s Single Year Raise / Adjustment?

The Social Security Raise is simply the cost-of-living-adjustment (COLA) which every retiree receives if there is inflation adjustment in the current year.

According to the SSA (Social Security Administration) the purpose of providing a COLA is to make sure that inflation doesn’t erode “the purchasing power of Social Security and Supplemental Security Income (SSI) benefits.”

The goal of the COLA increase is to keep retirees in the position of being able to sustain their lifestyle of the current year to the next year.

If there is inflation during the year, then the next year every retiree’s Social Security benefit should increase. If there is no inflation then, unfortunately, there will be no COLA for that upcoming next year.

How does the SSA calculate the Social Security Raise / COLA increase?

According to the SSA (Social Security Administration) “COLAs are based on increases in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The Bureau of Labor Statistics calculates the CPI-Ws on a monthly basis.”.

The SSA specifically uses the 3-month average of the 3rd Quarter’s CPI-W from year to year (July, August and September).

If the CPI-W is greater than the previous year there will be a COLA or increase in Social Security benefits for retirees. If the CPI-W is not larger, or more importantly inflation actually goes down, then there will be a 0.00% COLA.

The COLA can never be negative. Retirees can never see their Social Security benefit decrease because of a rise or fall in inflation.

Here are the steps on how to calculate any year’s Social Security Raise using the 2023 COLA of 8.70% as an example:

Step 1: Find the 3rd Quarter CPI-W per year:

The 3rd Quarter CPI-W numbers per month in 2021 are as follows:

-

- 267.789 in July.

- 268.387 in August.

- 269.086 in September.

- 268.420 is the average CPI-W for the 3rd Quarter in 2021.

The 3rd Quarter CPI-W numbers per month in 2022 are as follows:

-

- 292.219 in July.

- 291.629 in August.

- 291.854 in September.

- 291.900 is the average CPI-w for the 3rd Quarter in 2021.

Step 2: Calculate the difference in inflation from 2021 to 2022:

Take the CPI-W average of 2022 and subtract the CPI-W average of 2021 from it.

291.900 (2022) – 268.420 (2021) = 23.48.

Step 3: Divide the difference by the average 3rd Quarter CPI-W of 2021:

23.48 / 268.420 = 8.74%

The Social Security raise or COLA in 2023 = 8.70%

Please note: the SSA will round either up or down at 0.05%.

What the Social Security raise may be based on inflation?

To calculate the Social Security COLA 2024, we need to know the CPI-W averages of both 2022 and 2023.

Thankfully, we already know the average 3rd Quarter CPI-W for 2022 = 291.900 but the issue is that the 3rd quarter for 2023 has yet to end at the time of this report.

To rectify this and give us an idea of what the COLA could be we can look at the 2nd Quarter CPI-W average in 2023 (April, May and June).

The current Administration is stating that inflation is under control. If that is the case, we can assume that the CPI-W through the 3rd Quarter of 2023 will remain constant. So the inflation adjustment could be:

The CPI-W in June of 2023 = 299.394.

By applying the calculations that the SSA uses the Social Security Raise 2024 should be 2.50%.

The breakdown of the Social Security Raise 2024 is as follows:

299.394 (CPI-W average in 2023) – 291.900 (CPI-W average in 2022) = 7.47.

7.44 / 298.502 (2022) = 2.50%.

But what about Medicare?

Though the average retiree’s Social Security benefit should increase by roughly 2.50% a month there is still the fact that they must also pay for their Medicare premiums through their benefit automatically.

By law Social Security automatically deducts your Medicare premiums from any benefit you are receiving. Keep in mind that Part B premiums are automatic while Part D and Medicare Advantage premiums are optional.

Any increase you may receive from the COLA will be reduced by Medicare premiums.

What the Medicare 2024 premiums may be?

There are 2 significant factors in determining what the Medicare premiums in 2024 will be and they are;

-The projections of the Trustees of Medicare

– The past history of Medicare increases

1. Projections of the Trustees of Increase or Adjustment:

According to the Trustees of Medicare in their 2023 Report the Part B premium should increase by 6.00% from 2022 to 2023. The Part B premium in 2024 will be $174.80 a month which is up from $164.90 a month in 2022.

For Part D premiums the Inflation Reduction Act (IRA) of 2022 dictates that Part D premiums can only increase by as much as 6.00% regardless of market conditions.

Your average monthly benefit Medicare premiums should inflate by at least 6.00% this year and, unfortunately, they will reduce that COLA increase you should expect to receive.

2. The past history of Medicare Benefit increases:

Over the past 20 years Medicare Part B premiums have increased by about 5.20% annually, but 2024 appears to be a lot like 2022 and that is not really a good thing.

In 2022 the Centers for Medicare Services (CMS) announced that the program would absorb the costs of Adhulem, an Alzheimer’s medication for Medicare beneficiaries. Unfortunately, the cost of providing this benefit resulted in Part B premiums increasing by 14.55% from 2021.

The Part B premium in 2021 = $148.50 a month while in 2022 the Part B premium = $170.10 a month.

This year CMS is again announcing that Medicare will absorb the cost of another Alzheimer’s medication, Leqembi, too.

If the same rate of inflation applies in 2024 as it did in 2022 the Part B premium may increase by at least $24.00 a month.

If history does repeat itself your Social Security COLA will not be as high as you think it should be.

And then there is IRMAA:

For high income earners in Medicare there is also another tax that impacts their Social Security benefit too. This tax is known as the Income Related Monthly Adjustment Amount or IRMAA for short.

IRMAA is simply a surcharge on top of a person’s Medicare Part B and Part D premiums if they are earning too much income.

IRMAA consists of 5 different Thresholds with the first Threshold having a surcharge of possibly $69.90 a month in 2024 to the 5th and largest Threshold that has a surcharge of possibly $419.40 a month in 2024.

Depending on which IRMAA Threshold you reach and what your Social Security benefit may be there is a good chance that your take home benefit will be lower in 2024 than it is today.

If you are in IRMAA today, please be prepared to receive less Social Security benefits in 2024 than you did in 2023.

Please note: any Medicare beneficiary who reaches any IRMAA Threshold no longer receives the protection of the Hold Harmless Provision. To learn more about the Hold Harmless Act please click here.

Streamlining the Medicare Surcharge Calculation Process.

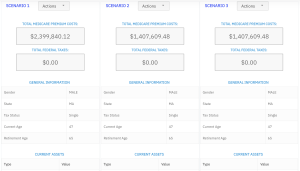

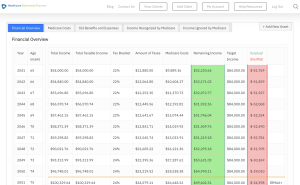

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.

FAQs

How can I Learn More about IRMAA as a financial professional

If you would like to learn more you can go to www.irmaacertifiedplanner.com for certification and designation to be an IRMAA Certified Planner

What is IRMAA?

The Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an amount you may pay in addition to your Part B or Part D premium if your income is above a certain level.

Does everyone have to pay IRMAA

How do I calculate my IRMAA exposure over the duration of a retirement?

Using the software provided by www.healthcareretirementplanner.com