Understanding the 401k contribution limits for 2024 is crucial to optimizing your retirement savings.

Don’t be overwhelmed – we’re here to help you make sense of the 401k contribution limits for 2024 so that your retirement savings can reach their full potential.

Navigating these regulations effectively could be what separates a comfortable retirement from financial stress in your golden years.

But if you’re not fully aware of how these 401k contribution limits for 2024 work, it’s easy to miss out on potential growth opportunities for your nest egg.

Navigating the Retirement Account Contribution Limits for 2024

As we gear up for 2024, it’s essential to understand retirement account contribution limits. This knowledge is particularly crucial when dealing with diverse workplace retirement plans such as the federal government’s thrift savings plan. With an increasing number of employees now aiming to retire at age 65, financial professionals must advise clients on strategies that facilitate higher savings than in previous years.

The Catch-Up Contribution Limit

A significant strategy in enhancing your clients’ retirement savings involves understanding and utilizing catch-up contributions. For individuals aged 50 or over, the IRS permits these additional contributions beyond regular limits – a provision commonly referred to as “catch-up contributions”.

This strategy offers opportunities for older workers who may have begun their saving journey later due to personal circumstances like raising children or caring for elderly parents. Here is more information from the IRS regarding this topic.

Defined Benefit Retirement Plans

In recent times, there has been a shift towards defined benefit pension schemes by states and employers alike, rather than sticking with traditional defined contribution ones. A case in point is Alaska, which recently decided that new hires will be enrolled in defined benefit schemes guaranteeing specific payouts upon retiring based on salary history and tenure instead of relying solely on investment returns.

- An increased trend toward Defined Benefit Pension Schemes might lead other states & employers to make similar changes,

- this could impact how you counsel your clients about their pension planning strategies,

- & ultimately change the overall approach towards building a solid retirement plan.

Unpacking Roth IRA Contribution Limits

The 2024 Roth IRA contribution limit is a crucial factor in retirement planning, particularly for single employees. It is essential to understand how these limits compare with other types of accounts, such as SIMPLE IRAs.

Roth Contributions Versus Traditional Contributions: The Tax Factor

A distinguishing feature between Roth contributions and traditional ones lies in the taxation rules. With a Roth IRA, you contribute after-tax dollars, which means withdrawals during retirement are typically tax-free. This can be advantageous if you anticipate being in a higher tax bracket upon retiring.

In contrast, contributions to traditional IRAs or 401(k)s are made with pre-tax dollars and are then taxed when withdrawn at your income tax rate during that time period. While this provides an immediate benefit by reducing current taxable income, it may result in higher taxes later on if post-retirement income puts you in a higher tax bracket than when the original deposit was made.

Catch-Up Provisions: An Opportunity To Boost Retirement Savings For Older Savers

- An important distinction beyond taxation differences between Roths and traditionals comes from catch-up provisions—an additional amount over regular annual caps—that older savers (those aged 50 or above) can contribute towards their plans.

- This provision allows those nearing retirement age more flexibility to significantly increase savings before leaving the workforce—a crucial aspect given that many now expect they will need to work longer into what would have been considered ‘traditional’ retirement years previously.

- The concept does not belong to grandma’s retirement plan but rather represents evolved thinking that effectively caters to generational differences while advising clients about future years.

Decoding the Impact of RMDs on IRMAA in Retirement Planning

The intersection between Required Minimum Distributions (RMDs) and Income-Related Monthly Adjustment Amount (IRMAA) is a critical aspect for financial professionals to consider while advising clients. It’s not just about understanding these terms but also mastering how they intertwine within the complex fabric of retirement planning.

Tactics to Diminish RMD Influence on IRMAA

Raising awareness around strategies that minimize the impact of mandatory withdrawals from certain types of retirement accounts once an individual reaches age 72, known as RMDs, is crucial. This knowledge equips retirees with tools necessary for preventing potential elevation into higher income brackets which consequently lead to increased Medicare premiums via IRMAA.

Catch-up contributions serve as one such strategy where individuals aged 50 or over are allowed additional contribution towards their workplace retirement plan beyond regular limits each year. This approach reduces future taxable income potentially lowering Medicare premium payments.

A Healthcare Flexible Spending Account (Healthcare FSA) offers another viable solution by reducing taxable income through pre-tax deductions made towards it.

Navigating Legislative Changes Affecting Both RMD Rules And Medicare Premium Calculations

- Beyond providing advice based on current regulations, guiding your clients through any legislative changes impacting both RMD rules and Medicare premium calculations holds equal importance.

- This includes staying updated about notifications related to IRS Notices regarding these matters.

- Informed decision-making allows successful navigation amidst changing landscapes.

Exploring Other Key Retirement Plan Contribution Limits

The retirement planning field is vast, with each account type having its unique contribution limits. Two significant areas to consider are the SIMPLE IRA and Healthcare FSA.

SIMPLE IRA Contribution Limit

A Savings Incentive Match Plan for Employees (SIMPLE) IRA allows employees to make salary deferral contributions while employers contribute matching or non-elective amounts. It’s important to note that these plans aren’t included in regular contribution limits.

This means if an employee contributes simultaneously to a 401(k) and a SIMPLE IRA, they must adhere separately to the annual additions limit for each plan type. This can significantly impact your clients’ investment strategies as they navigate their future years of retirement planning journey.

Healthcare FSA Contribution Limit

The healthcare Flexible Spending Account (FSA), another avenue for pre-tax savings, has its own set of rules regarding contribution limits. As per IRS guidelines, the maximum amount one can contribute towards a healthcare FSA in 2024 hasn’t been announced yet; however, this figure typically sees incremental increases year-on-year.

An increase in the healthcare FSA contribution limit offers individuals more opportunities to save on medical expenses using pre-tax dollars effectively within their comprehensive financial plan. Staying informed of shifts in legislation regarding various retirement accounts – from traditional IRAs and Roths to 401(k)s sponsored by employers – is critical when counseling customers on how to best disperse money across these vehicles.

Insights Into Future Changes in Retirement Planning

The landscape of retirement planning is rapidly evolving, thanks to the integration of artificial intelligence (AI) in HR management and the need to address ‘forgotten’ accounts. It’s clear that the retirement planning of today is not what it used to be.

The Role of AI in Managing Retirement Plans

In an era where efficiency and accuracy are paramount, AI tools such as Watson Assistant have emerged as game-changers for managing employee benefits like pension plans. These systems not only streamline processes but also offer unlimited access to data analytics.

This enhanced decision-making capacity can prove invaluable for both employers offering multiple plans and employees making Roth contributions or deciding whether they should work longer before retiring.

Addressing the Cost of ‘Forgotten’ Accounts

‘Forgotten’ accounts pose a significant challenge due to their high cost implications – according to research from the National Institute on Retirement Security, these overlooked funds amount to up to $1.65 trillion nationwide. This calls for innovative solutions by financial advisors during the planning process.

Generational Differences in Retirement Planning: Not Your Grandma’s Plan Anymore

Different generations have unique financial goals and expectations when it comes to retirement planning. This divergence necessitates a tailored approach by financial professionals, ensuring each client’s needs are effectively met.

Baby Boomers Vs Millennials – What They Want From Their Retirement Plans?

Baby boomers typically prioritize stability above all else, often preferring traditional pension plans or defined benefit schemes such as the federal government’s thrift savings plan. As they near the catch-up limit age of over 50, making additional contributions becomes an attractive option.

In contrast, millennials tend to favor flexibility, with Roth IRA contribution limits being particularly appealing due to their tax advantages now and in future years. With increased life expectancies compared to previous generations, this group also anticipates working longer if needed.

Customizing Financial Advice For Different Generations

To effectively cater to these generational differences, financial advisors need to strategize astutely based on the demographic cohorts of their clients.

The baby boomer generation may find value in maximizing employer-offered multiple plans like the federal government’s thrift savings plan where possible, while understanding the gift tax exclusion limit can be beneficial as part of estate planning strategies. Investopedia provides more details about the Gift Tax Exclusion Limit here.

For millennials who prefer flexible investment options early on, the focus could be on how Roth contributions can yield long-term benefits despite lower current-year deductions. Advisors should emphasize the importance of healthcare FSA contribution limits given the rising medical costs anticipated during their lifetime. Healthcare.Gov has some helpful information regarding this topic.

Table of Contents:

- Navigating the Retirement Account Contribution Limits for 2024

- Unpacking Roth IRA Contribution Limits

- Decoding the Impact of RMDs on IRMAA in Retirement Planning

- Exploring Other Key Retirement Plan Contribution Limits

- Insights Into Future Changes in Retirement Planning

- Generational Differences in Retirement Planning: Not Your Grandma’s Plan Anymore

- Conclusion

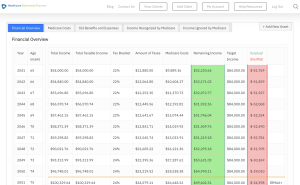

Streamlining the Medicare Surcharge Calculation Process.

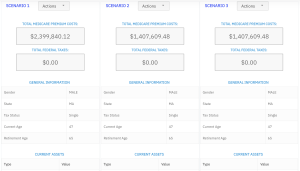

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.