401k alternatives can be a game changer when it comes to retirement planning.

The world of investing and saving for the future is vast, often leaving individuals overwhelmed with options…

This is where 401k alternatives come into play. They offer flexibility, potentially lower fees, and diverse investment opportunities.

Can you determine if these alternative plans are suitable for your needs? Let’s dive in to understand more about them.

What are 401k Alternatives?

A 401(k) is a popular employer-sponsored retirement plan, yet there are other options for financial advisors to consider when helping their clients plan for the future. Various alternatives to the conventional 401(k), with diverse features and investment options, can offer similar tax benefits.

Diversifying Retirement Accounts

In an era of increasing financial complexity, diversification has become a cornerstone strategy for many investors. This often involves considering other types of defined contribution plans offered or even examining cash balance plans as part of your client’s portfolio.

Cash balance plans create predictable income streams in retirement that mimic pensions and may be especially advantageous if you’re self-employed or work within small businesses. These operate much like defined benefit plans yet feature individual account balances akin to those seen in standard defined contribution schemes.

Roth Option: Roth IRAs and Roth 401ks

A growing trend among savvy savers who expect higher tax brackets during their golden years revolves around utilizing Roth IRAs and Roth 401ks. Unlike traditional IRAs where contributions grow tax-free until withdrawal (at which point they’re taxed), these ‘Roth’ options let funds expand indefinitely without taxation since taxes have already been paid on them before depositing into accounts.

Simplified Employee Pension Plan (SEP)

If your clientele includes self-employed individuals or business owners, introducing Simplified Employee Pension Plans (SEP IRA) could prove beneficial. Offering greater flexibility when making distributions compared to most individual retirement accounts while also providing more generous contribution limits makes SEP an attractive alternative choice.

Mutual Funds Outside Retirement Plans

Investment strategies needn’t always focus solely on formalized pension arrangements; direct investments into mutual funds outside any type of official retirement account might provide additional adaptability devoid from age-based distribution requirements typically associated with common retirement accounts such

Key Takeaway:

From diversifying retirement accounts to exploring Roth options, cash balance plans, SEP IRAs and even direct investments into mutual funds outside formalized pension arrangements – there’s a buffet of 401k alternatives for savvy investors seeking flexibility and tax benefits.

Advantages of 401k Alternatives

The realm of retirement planning extends beyond the traditional confines of a popular employer-sponsored retirement plan like the 401(k). Enter: alternatives to this conventional approach, offering potential advantages in terms of investment options, fee structure, and accessibility.

Diverse Investment Options

A notable edge offered by these alternative plans is their array of investment opportunities. While a traditional 401(k) might limit your clients’ choices primarily to mutual funds or company stocks, alternatives can open doors for investments into individual securities or even real estate depending on specific account types such as Roth IRAs or Simplified Employee Pensions (SEP).

This allows financial professionals more latitude when shaping client portfolios based on factors like risk tolerance levels and long-term goals – an aspect that could be pivotal in optimizing returns over time.

Fees Structure Advantages

Certain alternative accounts including Roth IRAs and simplified employee pensions often come with lower administrative costs compared to standard defined contribution plans offered by employers. This reduction in expenses means that more capital remains invested, which has potential implications for higher growth rates over time.

However, it’s crucial not to overlook any hidden charges; hence understanding all associated costs before advising clients towards particular strategies becomes imperative here.

Note: Always verify details about fee structures from reliable sources before making decisions.

Easier Access Without Penalty

In times where unexpected financial needs arise due to sudden life events, having access without penalties can become essential. Certain types of these alternate retirements offer just that. For instance, contributions made into Roth IRAs are taxed upfront rather than upon withdrawal, unlike most other defined benefit plan options, thus allowing tax-free withdrawals at any time after contributing. However, caution must be exercised while withdrawing earnings within Roth IRA prior to reaching age restrictions set under normal conditions unless exceptions apply according to IRS guidelines provided elsewhere.

Key Takeaway:

401k alternatives like Roth IRAs and Simplified Employee Pensions offer a wider range of investment options, often with lower fees. They also provide easier access to funds without penalties for early withdrawal, making them flexible tools for retirement planning.

Types of 401k Alternatives

Different retirement plans serve as alternatives to the traditional 401k, a popular employer-sponsored retirement plan. These options offer an array of investment opportunities and have unique rules for contributions and withdrawals.

Roth IRAs

A Roth IRA is an individual retirement account which allows for post-tax contributions, granting the opportunity to have tax-free growth when it comes time to retire and withdraw earnings at 59½. This feature enables your money to grow tax-free, which can be advantageous if you foresee being in a higher tax bracket during your golden years.

You’re permitted to withdraw earnings from this account without any taxes or penalties once you’ve hit age 59½ and maintained the Roth IRA open for at least five years.

Simplified Employee Pension (SEP) IRAs

If self-employment or owning a small business describes your situation, then opening up a Simplified Employee Pension (SEP) IRA could be beneficial. The contribution limit on these accounts is based on earned income rather than fixed dollar amounts, making them attractive due to their potential for high limits compared with other types of accounts.

Solo 401ks

The Solo 401ks are tailored specifically towards those who are self-employed with no employees apart from perhaps their spouse. They combine features seen in both traditional IRAs where employers may automatically enroll eligible employees into these programs along with elements observed within Roth IRAs such as post-tax contributions subject to certain thresholds while also allowing pre-tax contributions reaching defined benefit plan benefit limits.

Cash Balance Plans

- A cash balance plan offers another alternative by creating individualized participant profiles akin to how cash-balance defined-benefit plans implement their structure but promises participants specified benefits upon hitting retirement unlike most common forms like mutual funds-based savings strategies used in pension schemes including simplified employee pensions.

Deciding on the Best 401k Alternative

The task of choosing a fitting alternative to the popular employer-sponsored retirement plan, namely a traditional 401(k), requires thoughtful analysis. Key considerations include fees associated with various plans, available investment options, contribution limits, and potential tax implications.

Evaluating Fees in Retirement Accounts

Diverse types of retirement accounts come attached with different fee structures. For instance, some might levy administrative or management charges that can diminish your returns over time. Understanding these costs is pivotal before making any decision.

Assessing Available Investment Options

A variety of investment choices is another crucial aspect when picking between distinct retirement accounts. Some may favor having a broad selection of mutual funds and ETFs, while others feel more confident investing in individual stocks or bonds.

Tax Implications of 401k Alternatives

Understanding the tax implications associated with various retirement plan alternatives to a traditional 401(k) is crucial for financial professionals. Each alternative has unique taxation rules that impact how contributions are made and distributions are taxed.

Roth IRAs: Post-Tax Contributions and Tax-Free Growth

A Roth IRA operates on an after-tax contribution basis, meaning taxes are paid upfront on earned income before it’s invested into this type of account. This contrasts sharply with popular employer-sponsored retirement plans like a traditional 401(k), where pre-tax dollars fund your investment options.

The standout advantage here? Qualified withdrawals from Roth IRAs grow tax-free. If you anticipate moving into a higher tax bracket during your golden years than when making these initial contributions, this could lock in lower rates now for more significant savings later.

Simplified Employee Pension (SEP) Plans: Pre-Tax Benefits

Simplified Employee Pension (SEP) plans share similarities with traditional IRAs regarding their approach to taxation; they allow pre-tax contributions that then grow deferred until withdrawal at retirement age – mirroring defined benefit plan benefit limits closely.

This implies that any funds withdrawn will be subject to ordinary income taxes at whatever rate applies during one’s retirement years. Furthermore, if you’re self-employed or running small businesses, SEP plans offer substantial contribution limit benefits compared to other alternatives such as Roth or Traditional IRAs.

Cash Balance Plans: Employer-Sponsored Flexibility

In terms of flexibility and portability for employees, cash balance plans shine brightly among other types of defined contribution plans offered by employers. Similarities exist between these schemes and defined benefit pension systems too; both the employee and employer make pre-taxed investments while growth accrues via deferral until distribution becomes necessary upon meeting eligibility criteria such as specific ages or service durations, etc.

Key Takeaway:

Understanding tax rules for different retirement plans is key. Roth IRAs offer post-tax contributions and tax-free growth, ideal if you expect to be in a higher tax bracket later on. SEP plans allow pre-tax contributions with taxes deferred until withdrawal, beneficial for self-employed or small business owners due to high contribution limits. Cash balance plans provide flexibility and portability, with both

Withdrawal Rules for 401k Alternatives

Different retirement accounts, from Roth IRAs to Simplified Employee Pension plans, have unique withdrawal rules. It’s crucial for financial professionals to understand these regulations in order to guide clients effectively.

Roth IRA Withdrawals

A significant advantage of the Roth IRA, a popular alternative to traditional 401ks and other defined contribution plan options offered by employers, is its flexibility with withdrawals. Contributions can be withdrawn anytime without penalties – an attractive feature if funds are needed before reaching retirement age. However, earnings may face taxes or penalties if they’re accessed prior to turning 59½ unless certain conditions apply.

Simplified Employee Pension (SEP) Plan Withdrawals

In contrast with Roth IRAs and cash balance plans, Simplified Employee Pension (SEP) plans create individual accounts like those found in defined contribution schemes but follow different withdrawal protocols similar to traditional IRAs’ requirements. Starting at age 72 under Simplified Employee Pension plan guidelines, usually opted by self-employed individuals or small businesses who automatically enroll eligible employees into this scheme.

Savings Incentive Match Plan for Employees (SIMPLE) IRA Penalties

The Savings Incentive Match Plan for Employees (SIMPLE), another form of employer-sponsored retirement account that functions similarly to mutual funds investment options among others, has stricter early-withdrawal consequences compared with many alternatives – it levies up to a substantial penalty fee within two years since joining the program.

Note: While hardship distributions or loans against your savings could be possible depending on circumstances, such actions should generally only serve as last-resort measures due to their tax implications and potential impact on long-term growth.

To assist our clients best when planning retirements, we need a comprehensive understanding not just of how various investments grow but also knowledge regarding access norms during needs arising out of changing life situations, including moving into a higher tax bracket based upon earned income level changes, etcetera.

Key Takeaway:

Knowing the withdrawal rules of 401k alternatives like Roth IRAs, SEP plans, and SIMPLE IRAs is key to effective retirement planning. These options offer varying levels of flexibility and penalties for early withdrawals, so choose wisely based on your anticipated future needs.

Conclusion

Exploring 401k alternatives opens up a world of possibilities for retirement planning.

You’ve learned that these alternatives offer flexibility and potentially lower fees.

Different types, such as Roth IRAs, SEP IRAs, SIMPLE IRAs, and Solo 401ks, each come with their own unique features.

The choice depends on your personal financial goals, the contribution limits you’re comfortable with, and the tax implications you can manage.

Remember, withdrawal rules also vary based on different factors including age or financial hardship circumstances.

If this feels overwhelming or if you need help calculating costs like IRMAA in your retirement plan…

is here to assist.

We specialize in helping financial professionals navigate through these complexities. Let us guide you towards a secure future today!

Streamlining the Medicare Surcharge Calculation Process.

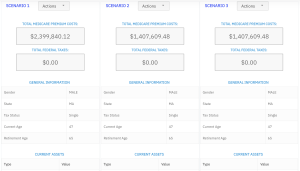

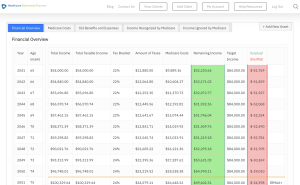

Our Healthcare Retirement Planner software is designed to streamline the retirement planning process for financial professionals. By providing an efficient way to calculate IRMAA costs, our tool helps you save time and focus on other aspects of your clients’ retirement plans.

- Faster calculations: Our software quickly calculates IRMAA costs based on your client’s income and tax filing status, eliminating manual calculations and potential errors.

- User-friendly interface: The intuitive design of our platform makes it easy for financial professionals to input data and generate results with minimal effort.

- Data integration: Seamlessly integrate our calculator into your existing financial planning tools or CRM systems for a more streamlined workflow.

- Easy to Understand Reports: Export reports to easily share with your clients

- Tax and Surcharge Modeling: see how different types of income affects both taxes and your surcharges.

In addition to simplifying the calculation process, using our Healthcare Retirement Planner can also help improve communication between you and your clients. With clear visuals that illustrate how IRMAA costs impact their overall retirement plan, you can effectively convey complex information in an easily digestible format. This enables clients to make informed decisions about their healthcare expenses during retirement while ensuring they are prepared for any potential changes in Medicare premiums due to income fluctuations. To learn more about how our software can benefit both you as a financial professional and your clients’ retirement planning experience, visit the features page. Streamlining retirement planning processes can help financial professionals save time and resources, allowing them to focus on other areas of their clients’ needs. Automated calculation of IRMAA costs is the next step in streamlining this process even further.