Understanding the intricacies of Medicare, including the Medicare Deductibles, is crucial for financial professionals advising retirees. This post intends to give a thorough comprehension of this intricate subject.

We will delve into how annual changes and usage frequency can significantly impact overall healthcare expenses for beneficiaries. We’ll also explore the differences between Original Medicare and Medicare Advantage Plans, with a particular focus on standalone Part D plans which cover prescription drugs.

The discussion will further extend to how lower-than-anticipated spending affects program budgets and the role played by recent pharmaceutical developments like Aduhelm in altering Medicare Deductibles. The variations in cost associated with Advantage Plan premiums due to factors such as location or provider network size are another essential aspect that we will scrutinize.

Finally, we’ll examine legislative actions like The Inflation Reduction Act that have far-reaching implications on pharmaceutical expenses under Part D. By setting out-of-pocket limits for services within networks, we can help you navigate these complexities more effectively.

Understanding Medicare Costs for Retirees

Retirees, brace yourselves for annual changes in Medicare costs. These changes can affect premiums, deductibles, copays, and other aspects of coverage that directly impact retirement healthcare financial planning strategies. A crucial factor to consider is the frequency of a retiree’s use of the healthcare system as this could significantly contribute to overall costs.

The Effect of Annual Changes on Medicare Costs

Annual adjustments in Medicare plans are often driven by factors such as inflation rates, policy amendments, or cost-of-living increases. For instance, Part B premiums have risen over time due to rising health care expenses and legislative modifications. Understanding these yearly fluctuations helps beneficiaries plan better for their future medical needs. Medicare.gov provides a comprehensive list of changes to Medicare costs each year.

How Usage Frequency Impacts Overall Health Care Expenses

The more frequently you utilize healthcare services, the higher your out-of-pocket expenses may be – even with comprehensive insurance coverage like Medicare. Regular doctor visits, frequent hospitalizations, or long-term prescriptions can all add up quickly and increase total expenditure considerably.

Beyond just understanding how much each service will cost upfront (i.e., copayments), it’s also important to understand what percentage of those services will be covered by insurance after meeting your deductible. This is especially true if you’re managing chronic conditions that require regular treatment or medication.

To navigate through these complexities effectively and ensure optimal utilization of benefits under various scenarios – whether high-frequency users or otherwise – it’s recommended to consult with professionals specializing in Healthcare Retirement Planning. IRMAA Certified Planner provides a list of resources to help you find a Medicare counselor near you.

To find an IRMAA specialist click here.

Key Takeaway:

Retirees should be aware of annual changes in Medicare costs, which can impact premiums, deductibles, and copays. These changes are influenced by factors such as inflation rates and policy amendments. Frequent use of healthcare services can significantly increase out-of-pocket expenses even with comprehensive insurance coverage like Medicare. It’s important to understand what percentage of these services will be covered by insurance after meeting your deductible. Consulting professionals specializing in Healthcare Retirement Planning is recommended for optimal utilization of benefits under various scenarios – whether high-frequency users or otherwise.

Choosing Between Basic Medicare and Advantage Plans

Retirees have two main options for healthcare coverage: Original Medicare with a standalone Part D plan or the increasingly popular Medicare Advantage Plans. This decision can significantly impact retirement healthcare financial planning strategies.

Comparing Basic Medicare with Standalone Part D Plans

The traditional route involves enrolling in Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance). Beneficiaries often add a standalone Part D plan for prescription drug coverage as well as Supplemental or Medigap Plans to cover charges within Parts A and B. However, these separate parts mean dealing with multiple premiums, deductibles, and copays.

Understanding the Benefits of Advantage Plans

Approximately 45% of beneficiaries opt for an all-in-one solution known as the Medicare Advantage Plan. These plans are offered by private companies contracted by Medicare. They cover everything that original Medicare does but also include additional benefits like vision, dental care, and wellness programs. Most importantly, they come bundled with prescription drug coverage under Part D.

- Ease of use: With one card for all services, you won’t have to juggle between different cards for hospital visits or prescription refills.

- Capped out-of-pocket costs: Unlike Original Medicare, where you could end up paying more if you need frequent medical attention, Advantage Plans have a limit on out-of-pocket costs.

- Bonus features: Some Advantage Plans offer extra perks such as gym memberships or transportation to doctor’s appointments at no extra cost.

The choice between Original Medicare paired with a standalone Part D plan versus opting into an Advantage Plan ultimately depends on individual needs and circumstances. It’s important to thoroughly research both options before making any decisions about your healthcare during retirement.

Impact of Lower-than-Anticipated Spending on Deductible Expenses

Retirees in particular can be significantly affected by fluctuations in healthcare expenditures. Recently, there was lower-than-projected spending on an Alzheimer’s drug called Aduhelm, leading to surplus within the Medicare program budget. This unexpected turn has resulted in some significant cost adjustments for beneficiaries.

Exploring how low spending affects program budgets

The lower expenditure on Aduhelm meant that more funds were available within the overall budget. When such scenarios occur, it often leads to financial readjustments across various aspects of coverage under Medicare. These alterations could mean reductions in costs associated with premiums or deductibles – expenses that directly affect retirees and their healthcare planning strategies.

The role played by pharmaceutical developments like Aduhelm

Advancements in pharmaceuticals and their subsequent market performance play a crucial role in these changes. In this case, Aduhelm’s lower than anticipated uptake not only impacted its manufacturer but also had ripple effects across Medicare’s financial landscape.

An immediate result was a decrease announced for Part B Deductible down to $226 – a welcome relief for many beneficiaries who are already grappling with rising healthcare costs during retirement years. However, while celebrating this reduction, one must remember that each year brings new challenges and potential shifts within the complex world of Medicare costs.

This situation underscores why keeping abreast with industry trends and legislative actions becomes critical when planning retirement finances around healthcare needs; ensuring you’re prepared no matter what comes your way.

Variations in Cost Associated With Advantage Plan Premiums

Not all Medicare costs are created equal. Some expenses have seen reductions, but Advantage plan premiums can vary and even increase depending on certain factors. Financial professionals must understand these variations when assisting clients with retirement healthcare planning.

Factors Influencing Premium Prices

A client’s location plays a significant role in premium costs. Urbanites may experience more expensive premiums than those in rural areas because of variances in medical care expenses. The size of the provider network is another factor that could influence premium prices. Plans with larger networks often charge higher premiums.

Analyzing Potential Increases

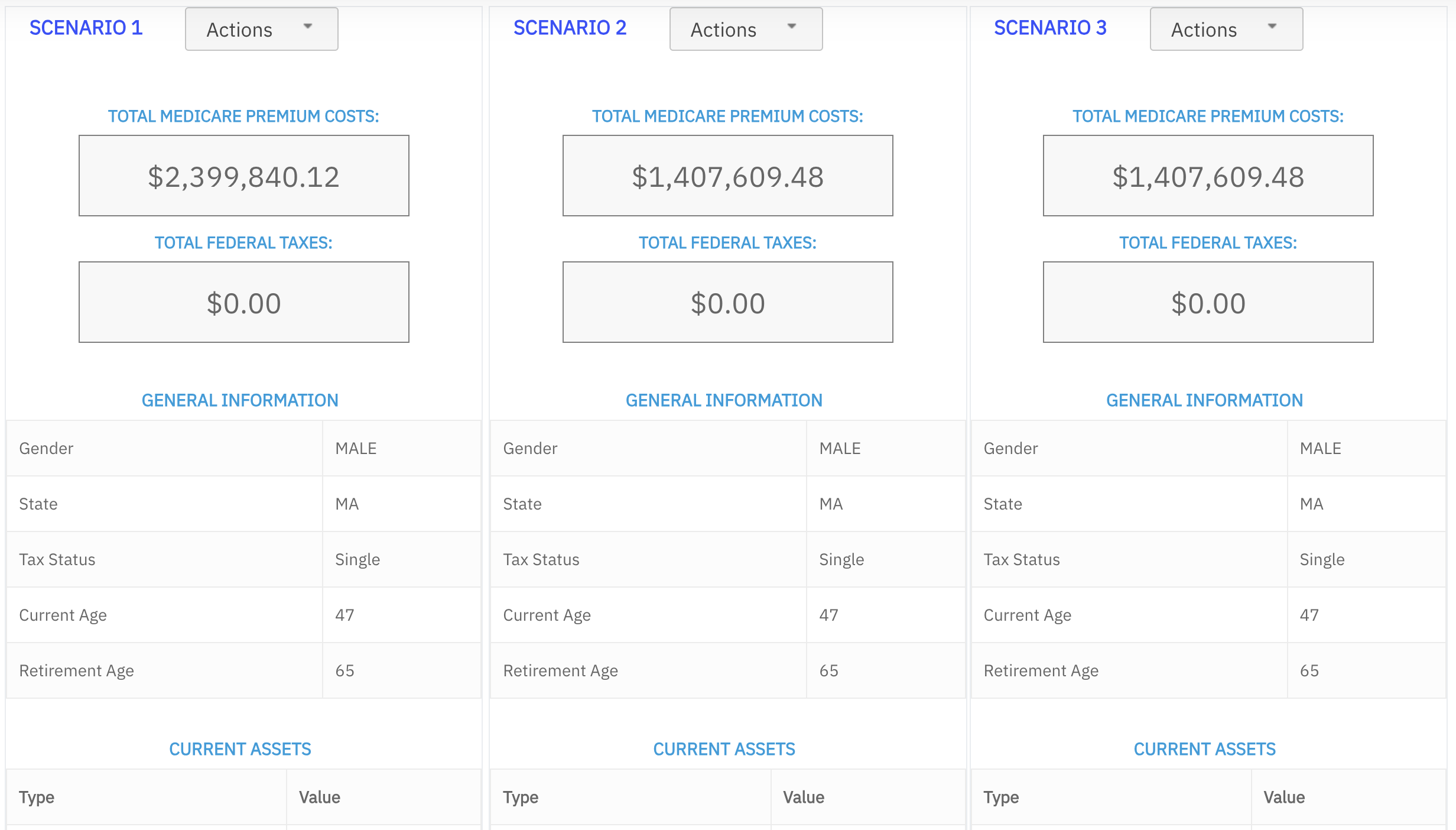

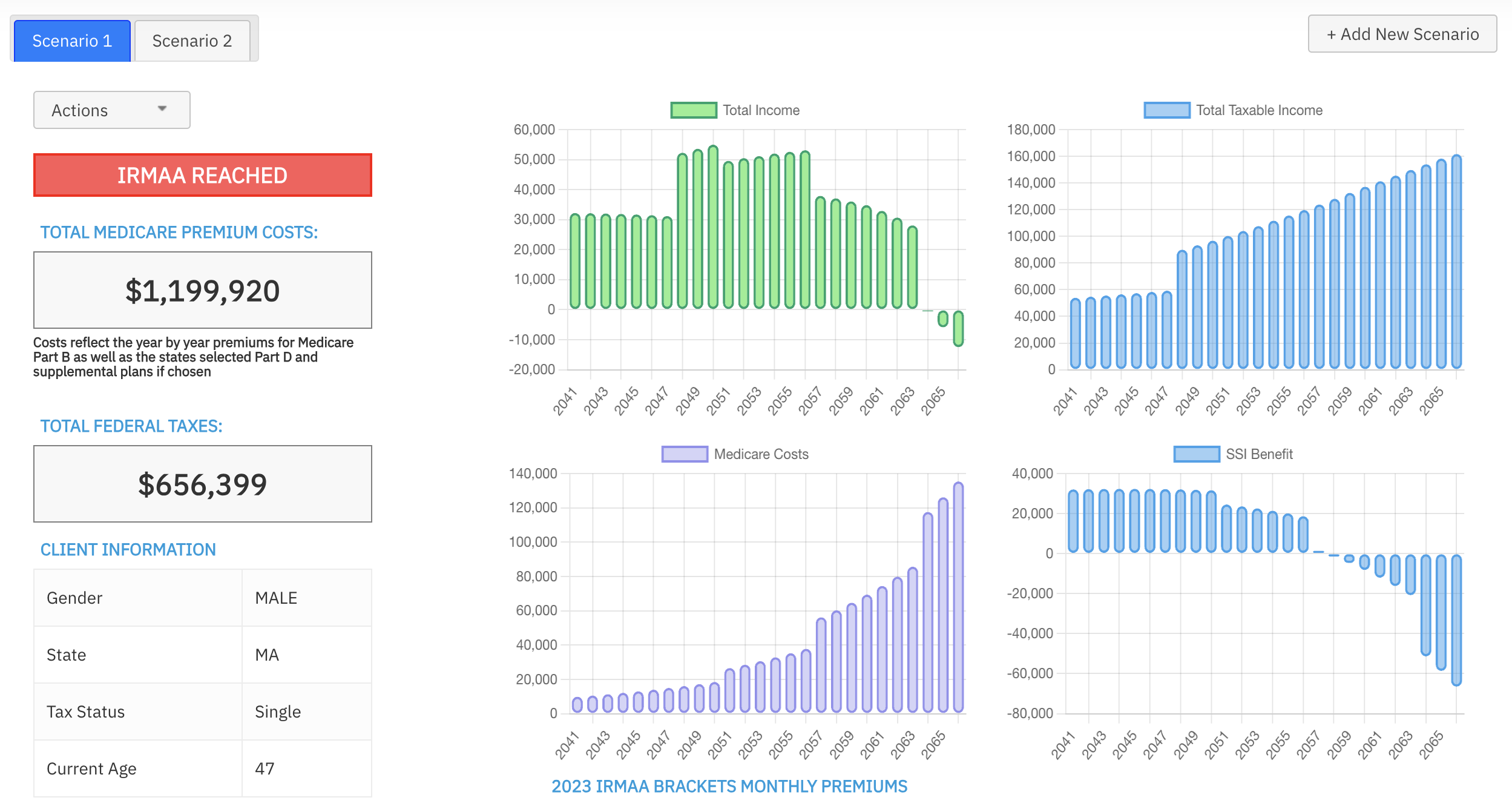

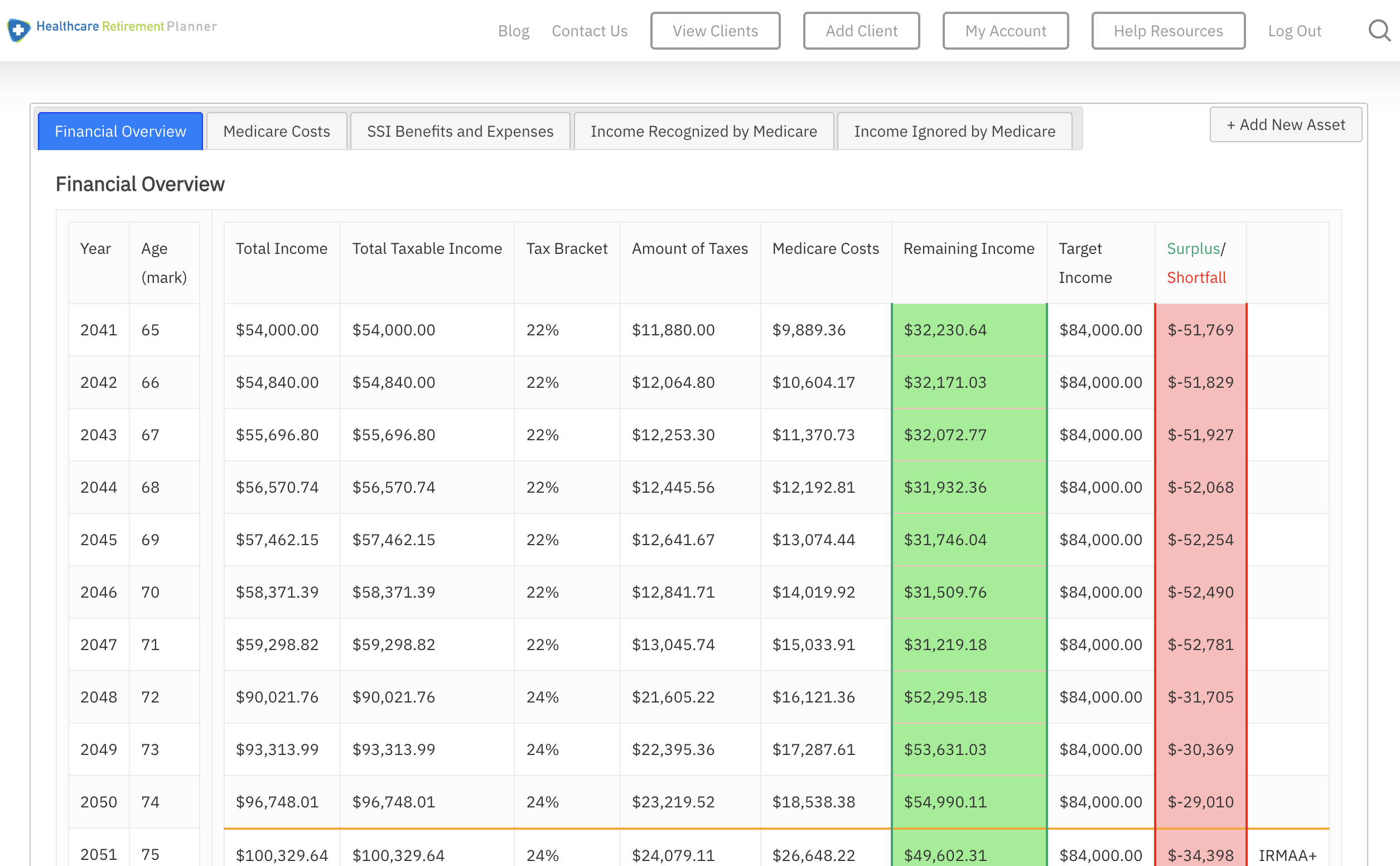

To help clients navigate potential increases, conduct an analysis based on their specific circumstances. Compare different plans available within their area or assess how changes to a provider network might impact overall costs. Use tools like our Healthcare Retirement Planner to provide detailed projections of IRMAA costs under various scenarios.

- Location: Use data from local health insurance companies and government resources such as CMS.gov.

- Provider Network Size: Consult information provided by individual insurers regarding the size and scope of their networks.

Understanding variations related to Advantage plan premiums will enable you to better assist your clients while developing robust retirement healthcare strategies tailored specifically for them.

Setting Out-of-Pocket Limit For Services Within Networks

When planning for retirement healthcare costs, it’s important to consider not only what you pay initially but also the maximum out-of-pocket amount that will be applicable in 2023 when enrolling in services from networks under Advantage Plans – set at $8,300. This is especially true if you opt into services from networks under Advantage Plans. The year 2023 will see this limit set at $8,300.

Analyzing out-of-pocket limits under various scenarios

The max a beneficiary must pay for covered services in a plan year is the out-of-pocket limit. After reaching this threshold, Medicare pays all costs for in-network care. However, these limits can vary depending on factors such as whether you choose an HMO or PPO plan and if you receive care outside of your network.

- HMO plans: These usually offer lower out-of-pocket limits but restrict beneficiaries to using providers within their network except during emergencies.

- PPO plans: They often come with higher out-of-pocket caps but provide more flexibility regarding provider choice – including those outside the network.

To make informed decisions about which plan best suits your needs and budget considerations, it’s crucial to understand how different scenarios could affect potential expenses throughout the year. Don’t be caught off guard by unexpected healthcare costs.

Note that while $8,300 might seem like a significant amount initially – considering deductibles and copays along with premiums – understanding its implications helps paint a clearer picture of overall healthcare expenditure when choosing between different Medicare options. It’s another piece of information financial professionals need when advising clients on retirement planning strategies related to healthcare coverage choices.

Remember: even though there are annual changes affecting Medicare costs – some predictable, others less so – staying informed allows better navigation through these complexities towards optimal outcomes for retirees’ health and finances alike.

Key Takeaway:

When planning for retirement healthcare costs, it’s important to consider the maximum out-of-pocket limit, especially when opting into services from networks under Advantage Plans. The out-of-pocket limits can vary depending on factors such as whether you choose an HMO or PPO plan and if you receive care outside of your network. It’s crucial to understand how different scenarios could affect potential expenses throughout the year in order to make informed decisions about which plan best suits your needs and budget considerations.

Legislative Action Impacting Pharmaceutical Expenses Under Part D

In recent years, significant legislative actions have impacted pharmaceutical expenses, specifically related to Part D coverage. The Inflation Reduction Act has been implemented to reduce the costs of medications, and provide relief for Part D beneficiaries.

The Influence and Implications of The Inflation Reduction Act

The Inflation Reduction Act has made a substantial impact on Medicare costs by limiting annual increases in drug prices to inflation rates. This prevents excessive hikes that could burden retirees and keeps costs down for those who rely heavily on prescription medications.

Not only does this legislation benefit individuals, but it also contributes to easing pressure on the overall Medicare system budget. A definite boon for all parties.

As a financial professional, it’s essential to stay informed about legislative developments and understand their implications on Medicare costs. By analyzing current medication needs and evaluating potential savings, you can provide better guidance while assisting with healthcare retirement planning decisions.

Understanding Medication Needs

- Knowing what prescriptions your client currently takes can help predict future spending under Part D plans.

Evaluating Potential Savings

- With lower drug prices thanks to the Inflation Reduction Act, calculate possible cost reductions over time – an essential aspect when crafting long-term financial strategies.

By staying up-to-date on legislative developments and understanding their implications, you can help your clients make informed decisions about their healthcare and retirement planning.

FAQs in Relation to Medicare Deductible

What is a Medicare Deductible and How Does it Work?

A Medicare Deductible is the amount you pay out of pocket for healthcare services before Medicare coverage kicks in, and it varies depending on the type of Medicare plan you have.

2023 Medicare Part B Deductible: What You Need to Know

The Medicare Part B Deductible for 2023 is $226.00 for the year, but it’s important to note that this deductible can change every year.

Is a Deductible Required for Medicare?

Yes, most parts of Medicare require you to pay a deductible before coverage begins, but there are some exceptions.

2023 Medicare Changes: What You Should Know

Changes to Medicare in 2023 include potential lower drug costs due to legislative actions like the Inflation Reduction Act and updates on out-of-pocket limits. For more information, check out the official CMS announcements.

It’s important to note that when it comes to Medicare, you should always be wary of political opinions or bias, personal experiences or anecdotes, and unverified information or speculation. Stick to credible sources to ensure you’re getting accurate information.

Conclusion

When planning for retirement or even when retired and utilizing the Medicare program the Medicare Deductible must be a consideration.

With proper coverage certain Deductibles (Part A) can be covered while there are still others that have to be dealt with (Parts B and D).